Why Gold?

We have become accustomed to using “paper” or “plastic” as money, but in reality the “dollar” we use is virtual money, not something of actual value. In truth, the modern economy is based on a numerical system of “accounts” and the numbers (FED dollars) we use as money are stored in and transferred between those accounts. The vast majority of those “dollars” do not really exist, and will never physically exist. All of the numbers in those accounts were created at some time by a banking institution as a debt obligation. This monetary creation scheme was engineered to perpetuate debt obligations and create inflation, which is a loss of value that we all pay to the bankers when we use their “money.” In simple terms, FED dollars are not really money, by strict definition, and if people were to study the operation of the Federal Reserve System it would reveal itself as a crime against humanity. Can we change this?

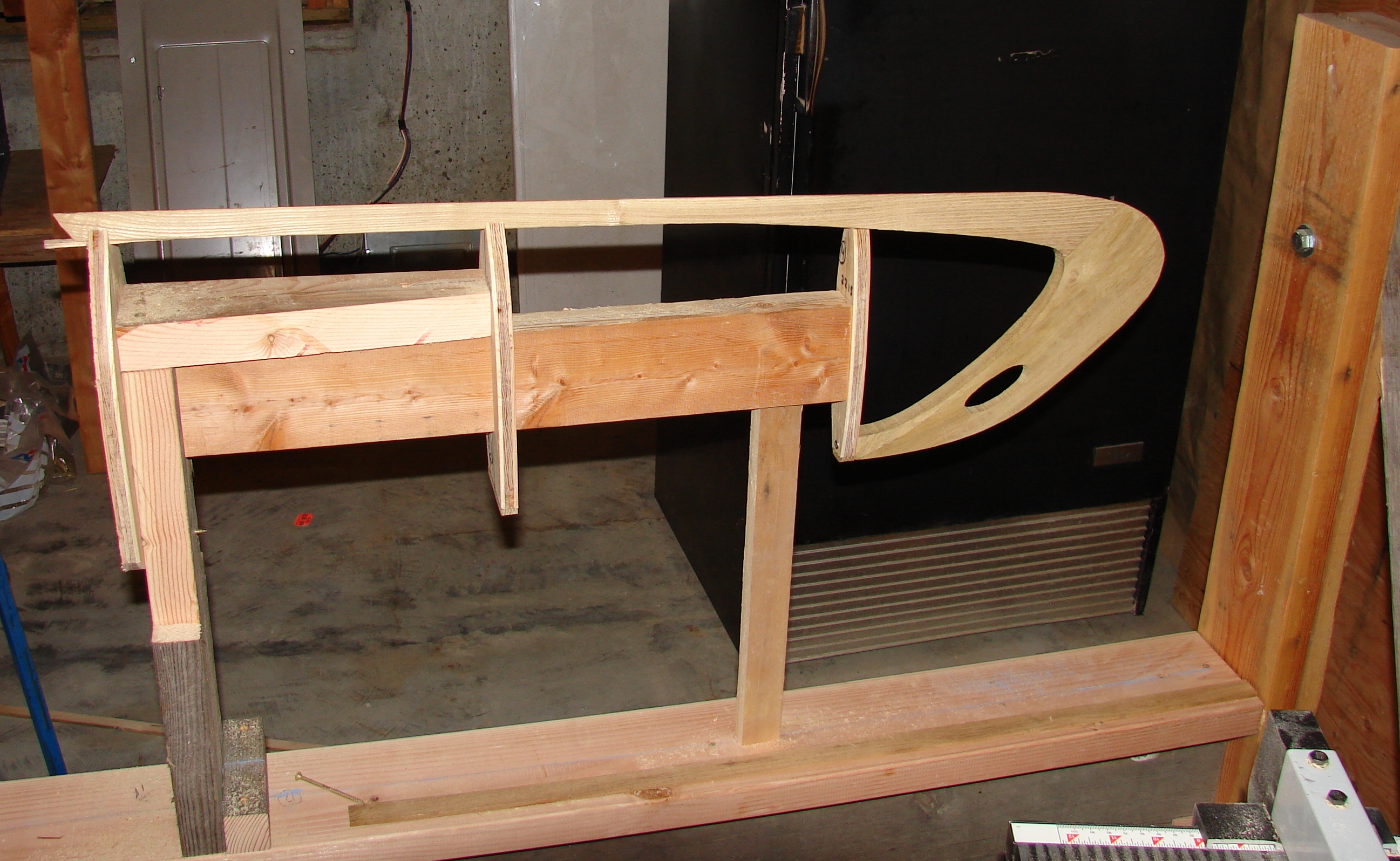

As Gandhi said, “Be the change you want to see in the world.” The Wahnooyak is priced in real money because we want to exchange value for value. Individually, we can’t change the nature of the FED economy but we can depart from it and engage an economy of value. Individually, we can be the change we want to see in the world. To that end, the Wahnooyak is priced in gold as the basis of its value. To understand “why gold?” continue reading:

Can you correctly answer the question, “What, as a matter of law, is a dollar?” Most people can’t. Most people also don’t understand what we use instead of the real dollar: the Federal Reserve Accounting Unit Dollar. Most people think the Federal Reserve is part of the U.S. government. It’s not. A cartel of national and international bankers has been operating the Federal Reserve since 1913.

Most people have no idea what fractional reserve banking is or how it affects them. Fractional reserve banking allows these banking interests to issue currency, at interest by loaning it into circulation. It’s popular to say that bankers create “money” out of thin air, but it’s more accurate to say they create “money” by the fractional reserve process based on “deposits” of numbers held in accounts and the current fractional reserve rate. At some point in time every Federal Reserve Accounting Unit Dollar that circulates in the economy was “loaned” into circulation using the fractional reserve process.

What does it really mean? The modern day “money” that we use is nothing more than numbers held by banks in accounts that we can access with either “paper or plastic.” Just numbers, not actual value, a value that keeps decreasing whenever it gets diluted by creating more “money” and issuing it into the money supply. A current term for this money creation is “quantitative easement.”

This is the cause of inflation. Inflation is a hidden tax that everyone who uses Federal Reserve Accounting Unit Dollars pays to the Federal Reserve. The Federal Reserve Accounting Unit Dollar has lost approximately 98 per cent of its purchasing power since the Federal Reserve was created. This “lost” value was “captured” by the Federal Reserve through the inflation “tax” we have all quietly surrendered to them. We don’t have to pay their inflation “tax” if we don’t use their Federal Reserve Accounting Unit Dollars.

So why gold? Gold and silver have held their value for thousands of years and continue to have a purchasing power equivalent to what they did well over a century ago. Back then, a dollar a day was a workingman’s wage. Today’s “dollar” won’t buy a cup of coffee on the way to work.

We have been conditioned to think of the dollar as a constant against which everything else of value can be measured. But the Federal Reserve Accounting Unit Dollar is anything but constant. Try thinking differently. Instead of thinking in terms of the price of gold going up and down think of gold as the constant. Gold is a pure metal, an atomic element. It resists tarnish and decay. Its real value, of course, is only whatever we value it at, but it has long held a recognized value. Consider the equation from this perspective instead: The price of gold is the number of Federal Reserve Accounting Unit Dollars it takes to purchase a constant: One Troy Ounce of pure gold. Gold is not going up or down, the Federal Reserve Accounting Unit Dollar is simply adjusting its “value” because of the inherent results of inflation by monetary creation.

Is it legal to not accept Federal Reserve Notes? If you look at a Federal Reserve Note it says, “This note is legal tender for all debts, public and private.” Legal tender laws compel the acceptance of a non-redeemable fiat currency for payment of debts. The key to answering the question is the term “debt.” We are only compelled to accept Federal Reserve Notes as a payment for debt. Our policy at Wahnooyak is to receive full payment with an order, or soon thereafter, so there is no debt. With no debt, there is no obligation to accept Federal Reserve Notes.

The prices for a Wahnooyak are in gold, but silver is also an acceptable form of payment and can be calculated at www.kitco.com. On the Kitco web site is the current gold to silver ratio based on spot prices. At the time of your order we can agree on a silver price for your Wahnooyak.

We prefer doing business in real money, but trades and barter can also be considered. Contact us.

How can you place an order and make a payment? First, contact us with your Wahnooyak order so we understand exactly what you want us to build for you. Then mail or otherwise deliver your gold or silver to us if you already have gold or silver. If you do not have any real money, contact Midas Resources (www.midasresources.com, 1-800-686-2237) and buy some with your “paper or plastic” and have them ship it to us.

We prefer U.S. minted bullion coins. Not all coins are created equal. The gold American Eagle, for example is one Troy Ounce, but the $20 Liberty or St. Gauden’s is .9675 of a Troy Ounce. The silver American Eagle is also a Troy Ounce, but the lawful silver dollar is only .7734 of a Troy ounce in mint condition, and about 72/100 of a Troy ounce after it has become well-worn “junk” silver. There are many foreign coins of various weights and purities and privately minted bullion coins that we can accept. Contact us and tell us what you want to offer as payment so we can see if we have a “meeting of the minds.”

The chaos and corruption in our political and economic realms can be directly linked to the operation of the Federal Reserve. Regardless of where each of us find ourselves on the political or economic spectrum, we are all adversely affected by the operation of the FED. But you and I can change this, one transaction at a time.

We can be the change we want to see in the world.

To learn more about the history of money, from Roman times, through the American Colonies and the creation and operation of the Federal Reserve, visit www.realityzone.com and purchase G. Edward Griffin’s book, The Creature from Jekyll Island.